DISCOVER THE TRICK TO DEVELOPING RICHES VIA REALTY INVESTMENT. UNLOCK YOUR FINANCIAL PROSPECTIVE TODAY!

Material Writer-Oakley Hildebrandt

Are you prepared to check out the realm of real estate financial investment, where opportunities for wide range production are as plentiful as a field of ripe fruit waiting to be plucked?

In this discussion, we will reveal the benefits of buying real estate, uncover approaches for maximizing returns, and clarified common errors to stay clear of.

So, secure your seat belt and prepare to embark on a trip that might potentially transform your financial future.

Benefits of Real Estate Financial Investment

Investing in realty offers various benefits that can help you create wide range and secure your financial future.

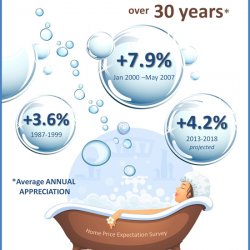

One of the crucial advantages of realty financial investment is the possibility for lasting admiration. With time, the worth of your building can boost, enabling you to offer it at a higher price and make a significant earnings.

In addition, realty gives a stable stream of revenue via rental residential or commercial properties. By renting out your properties, you can create a routine capital that can supplement your various other incomes.

Furthermore, principal global real estate fund offer tax advantages such as reductions for home loan rate of interest, real estate tax, and depreciation. https://postheaven.net/dominica3900august/buying-real-estate-creating-a-dependable-portfolio-for-a-protected-tomorrow can aid you minimize your total tax liability and increase your net income.

Methods for Optimizing Returns

To additionally improve your property financial investment capacity, executing reliable techniques is vital for taking full advantage of returns.

Right here are some key approaches to take into consideration.

To start with, expand your portfolio by buying different sorts of residential properties, such as domestic, industrial, or commercial. This helps spread out the risk and enhances the opportunities of higher returns.

Secondly, carry out https://www.digitaljournal.com/pr/real-estate-agent-naperville-realtor-contributes-to-clients-non-profit-agency-choice marketing research to identify arising trends and possible growth locations. By staying ahead of the marketplace, you can make informed financial investment decisions that generate higher profits.

Finally, take advantage of funding choices to raise your buying power and take full advantage of returns. By utilizing home mortgages or collaborations, you can acquire more residential or commercial properties and produce better earnings.

Lastly, actively manage your homes by ensuring normal upkeep, tenant screening, and timely lease collection. By being a responsible landlord, you can attract quality occupants and maintain a steady cash flow.

Common Mistakes to Avoid

One error that numerous investor make is failing to conduct extensive due persistance prior to buying a building. This can result in unexpected problems and financial losses down the line. To prevent this error, it’s vital to take the time to extensively research and assess the residential or commercial property prior to making a decision.

Right here are 3 vital areas to focus on during due persistance:

1. ** Financial Evaluation **: Analyze the building’s potential for producing positive cash flow and establish its success. Consider aspects such as rental income, expenditures, and possible recognition.

2. ** Marketing research **: Understand the neighborhood market conditions, including supply and need, rental prices, openings prices, and possibility for growth. This will aid you make educated decisions and recognize chances.

3. ** Home Inspection **: Employ an expert inspector to examine the residential property’s problem and identify any potential problems or repair work needed. This will certainly help you avoid unanticipated costs and make certain the home is in good shape.

Verdict

So there you have it, individuals! Real estate financial investment is absolutely a goldmine for wide range creation. By adopting smart methods and staying clear of usual challenges, you can maximize your returns and secure a flourishing future.

Bear in mind, don’t put all your eggs in one basket and constantly do your due diligence. As the saying goes, ‘Don’t count your chickens prior to they hatch,’ however with real estate financial investment, you’re bound to gain the rewards in no time!

Happy investing!